Syncing Rates and Budgeting for Temporary Retirement Reduction

The FY20/21 fringe benefit rates have been added to KC. This year’s rates include a temporary reduction of retirement match for executive management, and non-unionized faculty and academic staff.

Budgets created 7/10/2020 or after, will include the new rates (including the temporary retirement reduction) without having to take additional steps. For budgets that were created, or copied from budgets that were created, prior to 7/10/2020, you can update the rates by taking the following steps:

- Click the “Sync Rates” button in the Fringe Benefits panel and in the Flat Rate Inflation panel on the Rates tab. If you have not changed any rates on the Rates tab you could also click the Sync All Rates button at the bottom of the tab.

NOTE: If OSP has already approved your budget and you’d like to revise it to pull in the new rates, you must change the status back to Not Approved in order for the Sync Rates buttons to appear. If you take this action please let your Proposal Team know so they can re-approve the budget. On the contrary, if you are close to finalizing your budget and do not want to pull in the updated rates do NOT click the Sync Rates buttons on the Rates tab.

- The temporary retirement reduction is only mapped to the Faculty (Salaries & Wages) object code. This object code will calculate the temporary reduction for the period of 7/1/2020 – 6/30/2021 (FY20/21). If your budget period(s) include a portion of FY20/21, the retirement match will be prorated with 5% for dates within FY20/21 and 10% for dates outside of that timeframe.

If your budget was created prior to 7/10/2020 and you had already used the Faculty (Salaries & Wages) object code, you will have to take the following steps in order to pull in the reduced retirement rate:

- In the Faculty (Salaries & Wages) object code, delete all lines out of the budget by clicking the Delete All button for each line.

- Verify that you have already sync’d rates following step 1 above.

- Re-add the lines for the Faculty (Salaries & Wages) object code manually or by clicking the add all to period 1 button, and adjusting the dates and entering effort/charge %’s.

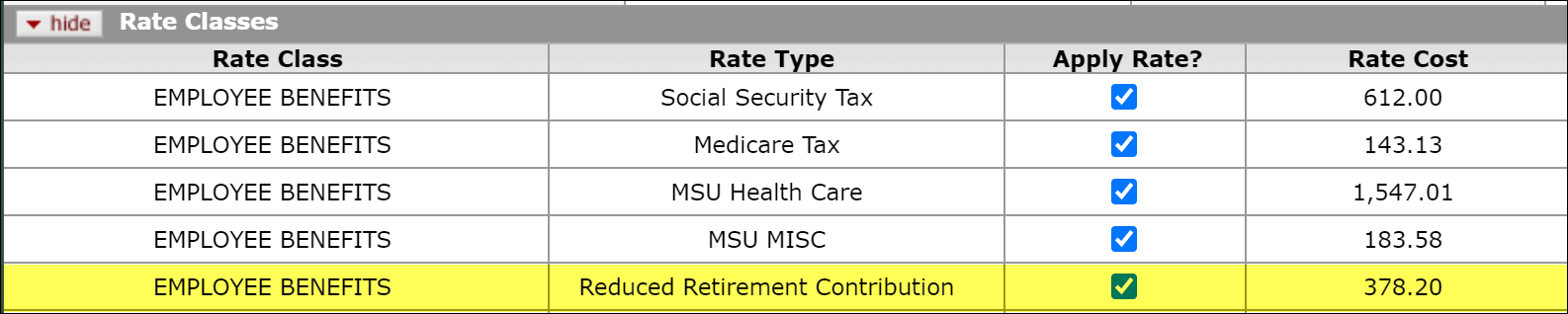

- Once you have re-added the individuals, you will notice the description for the retirement Rate Type in the Rate Classes subpanel will have changed to Reduced Retirement Contribution. This description for the Rate Type will remain in all years of the budget for the Faculty (Salaries & Wages) object code, even though the reduced rate will only be effective for FY20/21.

If you are budgeting MSU personnel who are not faculty, but they fall under the temporary retirement reduction (e.g. non-unionized academic staff), you will need to follow the steps above, adding them with the Faculty (Salaries & Wages) object code. We recommend using the Group feature so the person(s) will have separate line item details, which will allow you to change their Budget Category from Senior Personnel to another personnel category (e.g. Other Personnel). Changing the Budget Category will place them in the correct line item on the S2S budget forms. Please note, some of the KC budget reports pull based on the Budget Category (e.g. Report #4) and others pull based on the object code (e.g. Report #5), so there will be inconsistency on where these individuals show on the KC budget reports.

If you have any questions on how the FY20/21 rates are calculated in KC, please contact the KC Helpdesk or your OSP Proposal Team.